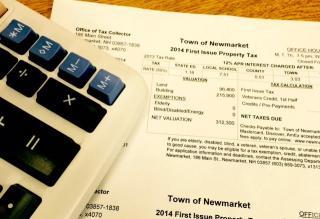

TOWN OF NEWMARKET TAX RATE SET AT $29.49

Newmarket Town Manager Steve Fournier announced today that the State of New Hampshire Department of Revenue Administration (DRA) has set the Property Tax Rate for the fiscal year ending June 30, 2024, for the Town of Newmarket. The Tax Rate is $29.49, an increase of two dollars and fifty cents per thousand of assessed valuation or 9.3%.

The following is a breakdown of that rate:

|

| FY23 |

| FY24 |

| Difference |

Town | $ | 6.27 | $ | 6.79 | $ | +0.52 |

Local School |

| 18.36 |

| 19.81 |

| +1.45 |

State School |

| 1.42 |

| 1.97 |

| +0.55 |

County |

| 0.94 |

| 0.92 |

| -0.02 |

Total |

| 26.99 |

| 29.49 |

| +2.50 |

In comparison to FY2023, the FY2024 Town portion of the Tax Rate increased by 8.3%, the local School rate increased by 7.9% and State Education Rate increased by 38.7%. The County portion decreased 2.1%.

The average single family home value in Newmarket is currently $385,000. The average homeowner will see an annual increase in their tax bill of $962.50. Here is where the increase is going on the average home:

Portion of Average Tax Bill |

| FY23 |

| FY24 |

| Difference |

Town | $ | 2,413.95 |

| 2,614.15 | $ | +200.20 |

Combined State and Local School |

| 7,615.30 |

| 8,385.30 |

| +770.00 |

County |

| 361.90 |

| 354.90 |

| -7.70 |

Total |

| 10,391.15 |

| 11,354.35 |

| +962.50 |

The Town Clerk - Tax Collector is in the process of preparing the bills now. That office is anticipating the bills to be issued shortly. Tax bills will be due on December 6, 2023.

The Town Manager encouraged those who may have a question on their bill to call the Town Clerk - Tax Collector at (603) 659-3617 ext. 4070.

The Town Manager encouraged those who may have a question on their property value, to contact the Assessor at (603) 659-3617 ext.1313.